CREDIT IS POWERFUL

The power of credit is life-changing! It is natural to resort to using credit when we are in great financial need, yet running out of cash.

Instead of pawning our precious assets in exchange for the amount that we need (which is commonly minus the applied interest).

We can apply for different types of loans with convenient terms of payments and affordable interest rates.

In addition, there are also instances when the lender provides rebates and other forms of financial incentives to their clients.

MAKE HAVING GREAT CREDIT A PRIORITY

Making credit an advantageous alternative when you are in great financial need.

However, there are individuals who do not understand the limitations that must be followed when resorting to credit.

Since credit allows them to make purchases in the absence of cash.

They tend to spend more than what they can afford to pay later on.

Resulting to piles of debt at the end of the billing period.

Though credit limits are strictly enforced, there are individuals who manage to slip away from their credit limits.

Thus they are acquiring more debts until the time comes that they cannot repay such debts anymore.

CREDIT SCORE SYSTEM

It is important to be aware of your limitations when using credit to make purchases or payments. Especially with regards to the credit score system.

There are many individuals who are unaware of what the credit score system consists of.

So you are not alone if you are one of them. The credit score system has been in effect for quite some time now.

Lenders use this to determine whether a loan application is accepted or rejected.

How can credit score system work for your financial needs?

First, let us define what a credit report and score is, and understand the system itself as a whole.

Keep in mind that it is a vital report that you must be aware of.

That is, if you want to have your loan application to be accepted.

“Points would be awarded for every factor that manifests debt repayment. These points will be summed up, and it will tell how likely you will be able to make payments when they are due. This will now be your credit score—a three digit number.”

ASSESSING CREDIT WORTHINESS

Credit score is a statistical manner of assessing the credit worthiness of a borrower.

And, your credit report possesses every inch of information about your credit experiences.

Your loan paying history, the accounts that you own, and the age of each account.

Late payments that you have made prior to your latest loan application (if there is any).

As well as existing outstanding debts that you failed to pay (if there is any).

CREDIT SCORE SYSTEM

The credit score system works through a statistical method. Which is used to make comparison of your credit profile with other borrowers with similar profiles.

Points would be awarded for every factor that manifests debt repayment.

These points will be summed up, and it will tell how likely you will be able to make the payments when they are due.

CREDIT SCORE MODELS

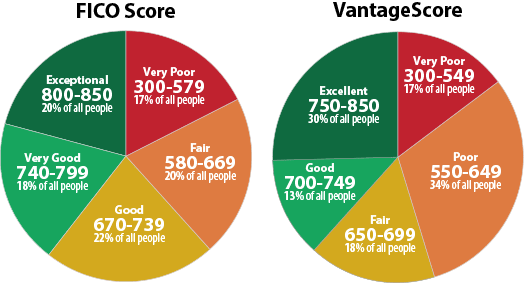

This will now be your credit score—a three digit number. Lenders primarily use the services of FICO to calculate your credit score.

Some lenders are starting you use the VantageScore scoring model.

As it considers other factors, and is more forgiving compared to FICO’s scoring model. (Both scoring ranges are below)

Which allows lenders to approve more consumers for their loans or credit cards.

Each time you will borrow or use credit for purchases or payments your credit report will update.

When this update actually posts depends on when your lender reports to credit bureaus.

Managing your credit card and loan payments effectively will score you points monthly.

EXCELLENT DEBT PAYMENT IS KEY

Lenders rely on credit scoring system that gives grades to your credit performance.

For instance, once you have an excellent credit performance on your previous loans, you will be able to attain a credit score of 600 or above.

In case your credit rating is ranging from 500 to 535, expect that you will experience difficulties of securing loans with affordable interest payments.

Your score is recorded in your credit report, which is managed by credit reporting agencies such as Equifax, Experian and TransUnion.

Your credit report is divided into four major sections, which is the following:

• Personal history

• Identifying information

• Inquiries

• Public records

CONCLUSION

Maintaining a good credit score takes continuous hard work. Thus, it is important that you understand what you are dealing with to avoid complications later on.

Making timely payments on credit cards and loans can be optimized by setting up bill pay through your bank or credit union.

Do not allow creditors to put you on their recurring debit payments as you have little control over it.

Using your bank or credit union’s automatic bill pay services gives you a lot more control and peace of mind.

Keep in mind your limitations in terms of using credit—and you are bounded to stick with it.

Or else, suffer the adverse consequences.