5 CREDIT TIPS TO INCREASE YOUR FICO SCORE

These 5 credit tips will increase your FICO score tremendously. The tips take advantage of FICO’s credit scoring system model. Many focus on removing negative items, however, good credit payment history will improve credit scores.

Please listen carefully and apply these tips as you embark on your journey to creditworthiness.

How Credit Scores are Calculated

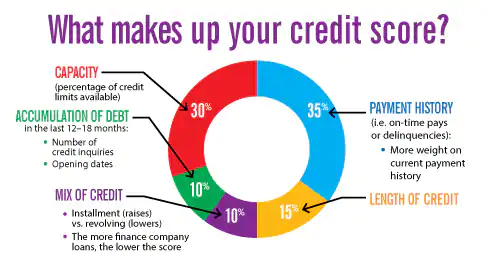

FICO (Fair Isaac and Company) is the company that created the credit scoring model that is most widely used by creditors today. The FICO criteria basically breaks down as such; payment history, credit utilization, length of credit history, credit mix, and new credit.

These 5 factors must be your focal point if you want to maximize your credit score and achieve 700 club status.

Tip #1

Make Payments On Time

To score the most points you must pay your accounts on time at all costs. Payment history is worth 35% of your credit score. The largest amount of the 5 factors. Creditors pay close attention to the last 24 months of your payment history.

Negative items/accounts affect you the most within the last 24 months of your payment history. The contrary is true when making payments. Each payment you make increases your potential to score points and improve your FICO score.

Automatic Bill Pay

Ensure timely payments by using your banks automatic Bill-Pay service. This will keep you from accidentally defaulting. Be cautious when pondering to use a creditors automatic payment as you may be charged for things you did not plan on paying for.

Sometimes creditors will increase a payment to no fault of your own. Using automatic bill pay from your bank will give you control over the amount paid to your creditors.

That will prevent surprises and your future self will thank you.

Budgeting is Key

A budget is key to bill pay execution. Without it you will fail. Your spending is always likely to exceed its limits when you have no budget. Allow your budget to dictate your allowance for expenses.

That way you will always spend within your means and have no issues paying back debt on time.

There are many different budgets you can find easily online, or you can use apps like MINT to help you achieve saving goals and track your spending habits.

Once you have your budget in place you really focus on paying down credit cards to improve credit utilization.

Below is a chart explaining the breakdown of the 5 factors that make up your credit score.

Tip #2

Pay Down Credit Cards to Lower Credit Utilization

Paying down credit cards will definitely increase your credit score tremendously.

Credit utilization is worth 30% of your credit score. If you are not familiar with this term, it’s your debt to credit ratio.

Also known as amounts owed. Something you should note and pay attention to, is that credit utilization is only impacted by credit card debt and not loan debt. This is commonly mistaken by many.

That’s why the better term for is credit utilization and not amounts owed. That sounds like any debt versus what it actually is, which is credit card debt only.

Credit card balances should be 30% or lower than your credit card limits. To maximize FICO scores keep your balances between 1-3 percent of the credit limit.

Credit Card Balance VS. Credit Limit

Credit balance is the amount you spend on the credit card. While the credit limit is the ceiling of that credit card. For example, if you use a brand new credit card that has $1,000 of available credit on it and you buy a watch for $100, your balance is now $100 and your credit limit is $1,000.

To find out your credit utilization percentage you would divide $100 by $1,000 and you would come up with a 10% credit utilization.

Which is very good. Remember, you balance should be no more than 30% of the credit limit.

Debt Snowball VS. Debt Avalanche

Two popular methods of paying down debt are the Debt Snowball and Debt Avalanche methods. Which one is better for you? That depends on how you are motivated and practical you are.

The Debt Snowball Method gives you more of an instant gratification, while Debt Avalanche Method saves you more money.

Debt Snowball Method

Let’s start with the one you may know of already; debt snowball. This is the infamous Dave Ramsey method. His method is to contribute the majority of your money to pay down the lowest amount owed, and pay only the minimum payment on the other debts.

Once that debt is paid off, then focus on the second lowest amount owed, and so on.

This is so you get instant gratification and feel more accomplished sooner rather than later. For some of us, that is a better way to get the job done, while others will think, “How do I pay this debt off fast?” And, “which debt is costing me more money to carry?”

If that’s you, then the Debt Avalanche is a much better option.

Debt Avalanche Method

The Debt Avalanche Method is slightly different than the Debt Snowball Method. It’s more of a debt payment plan on steroids.

Instead of allocating remaining funds to the lowest debt amount account, you contribute it to the debt with the highest interest amount.

Making your payments more effective and increasing your credit score each month. Resulting in faster and cheaper debt payment.

Tip #3

Increase Credit History

I know what you’re thinking, how do I increase my credit history? Good question. The answer is authorized user credit cards. People have been using this method to increase credit scores for decades.

Parents add their children as authorized users to their credit cards to increase FICO scores, assisting with purchasing a car or home.

Now days it can be used to help increase a score to obtain a personal loan, a lease for an apartment, or even landing a job. But first, you must find somebody with the right credit card.

How to Get Authorized User Account

It’s simple, you find a family member that has a seasoned credit credit card first. A seasoned credit card means it’s at least 24 months old. The older the card the better. Make sure the credit utilization on the card is at or below 30%.

Explain to the card holder that you will not receive their card, and will not be able to make any purchases. Tell them you are using their credit card to increase your credit score.

Once you are added as an authorized user their credit card, their payment history will be reported to your credit report.

Once it’s reporting, that will increase your credit score. That is important for them to understand. Make sure they understand you cannot get access to their actual credit card.

How to Pick an Authorized User Account

To insure you pick the right credit card, ideally the payment history should be flawless, however you can still use it if the late payment occurred 24 months ago or earlier. Remember, 30 days late or more will negatively affect the credit score.

If payment is less than 30 days late, that will not show on your credit report and will not earn an adverse mark on your report.

Make sure the credit utilization on the card does not exceed 30%. It is okay if it’s at 50% as long as they are paying it down, over a month or two the utilization will drop and earn you more points.

Once you identify a friend or family member that has a qualifying credit card, ask them to add you to the card as an authorized user.

Tell them not to worry, you will not receive their credit card in the mail and rack up charges at the mall. That’s because they will send the card to themselves.

How To Be Added As An Authorized User

Here are some key things to remember when having family add you as an authorized user:

- Have them call their credit card company and add you over the phone.

- Let the rep know they are adding a family member on the card.

- This is important: they must use their address as the shipping address. That’s for their own piece of mind. That way they know you do not have the card because they will.

- The rep will ask them for your name, social security number and date of birth. So make sure they already have that info before they call.

- Make the process turn-key for your friend or family member. They are doing you the favor afterall, it’s in your best interest to make it as easy as you can on them

- Ask your friend or family member to contact you once the credit card comes in the mail for confirmation that you were added as an authorized user.

Authorized User Saves Lives

Your credit scores will rise once your newly added seasoned line of credit is reported to the credit bureaus. Depending on the card’s credit limit and it’s balance you may see a boost of 50 to 150 points.

The higher the limit and lower the balance, the higher the score will increase.

An authorized user credit card line is a credit scores best friend just like a dog is man’s best friend.

How an Authorized User Accounts Can Harm You

The pros of an authorized user account are obvious at this point, but be cautious as they have the potential to be just as harmful. Since the card is not yours, you do not have control over what is charged to the card.

Be sure to explain to your benefactor that you are using their line of credit to increase your score and over spending can negatively affect your credit score.

As well as late payments. Either one can potentially decrease your score anywhere from 30 to 100 plus points. Please stress that point to your friend or family member.

Tip #4

Credit Mix / Credit Cards and Loans

Credit mix is worth 10% of your credit score. It’s self explanatory, it refers to the types of credit lines you have on your credit report. To maximize credit mix you will need 4 credit cards and 2-3 loans.

It’s good to have an auto loan, mortgage loan and personal loan. That’s how you get in the 800 club.

Tip #5 – New Credit / Inquiries

New credit is also worth 10% of your credit score. Inquiries occur when you apply for new credit. Each time you apply that registers as a hard credit pull and dings your credit score 3-5 points each time it is pulled.

Ideally you want to stay around 3 inquiries per year. More than three inquiries will jeopardize your credit scores and they will drop.

Conclusion

To increase your credit scores you must score big in the 5 factors FICO uses to calculate them. Now you know how FICO’s criteria works and can use them to your advantage. Here is a recap:

- Payment history is 35% of score – Make payments on time. Use an authorized user credit line to improve your payment history. Make sure the AU credit line status is “paid as agreed” and has no late payments in the last 24 months.

- Credit utilization is 30% of score – Pay down credit card balances to 30% or lower of the credit limit. Use an authorized user line of credit to improve your credit utilization.

- Length of Credit History is 15% of score – Ideal length of credit history should be 2 years or older, if not you can use an authorized user line of credit to raise your credit history and increase your credit scores.

- Credit Mix is 10 % of score – Ideal credit mix is 4 credit cards and 2-3 loans

- New Credit is 10% of score – More than 3 inquiries a year can really add up and decrease your credit scores. Each inquiry decreases your score by 3-5 points. Some say even more. Keep your inquiries around 3 a year and this should not affect much at all.

Being mindful of the 5 factors and how they score you points will keep you in the 700 club and if you’re really cooking, the 800 club. It happens. Happy hunting.