Experian Boost

Let’s talk about Experian Boost. Some of you may already have knowledge of it, but I’m sure a lot of you are not aware of all its cool features.

It has helped so many consumers boost their credit score up.

Before I get into all of that, I wanted to share my biggest pet peeve with the credit bureaus.

I always thought it was crazy how the credit bureaus would not report all the bills you were paying.

However, if you stopped paying those same bills and were sent to collections, all of a sudden the credit reporting agencies would magically report your shortcomings on your credit report.

But, the credit bureaus never reported any of your previous timely payments leading up to the late payments.

That is all changing thanks to Experian Boost. Well, at least for Experian. The best part about it; IT’S FREE!

Raise Your Credit Scores Instantly

As I just alluded to, Experian Boost makes it possible to get credit for phone and utility bills you currently pay to positively impact your credit score.

Once you apply Experian Boost your score will immediately be recalculated and a new credit score is generated.

Experian will also give you a new report and FICO Score.

The new score you receive is based on FICO Score 8 model. Y

our lender may use a different scoring model other than FICO Score 8.

If the lender or insurance you apply for does not use FICO Score 8, your score on Experian may not improve much at all.

Keep in mind, Experian Boost only improves your credit score for lenders and insurance companies that pull their reports from Experian.

These same lenders and insurance companies also have to elect to use the FICO Score 8 model for Experian Boost to help you.

Make sure you find out both before applying with a lender:

- Find out if the lender is using Experian to pull your report

- Find out if the lender is using FICO Score 8 scoring model

I know what you are thinking, “how does it work?”.

How It Works

As mentioned before, Experian Boost gives you the long deserved credit for paying utility and mobile phone bills. Here’s how it works:

- It will be required that you connect your bank account you pay your bills with to Experian. Don’t worry, your information will remain private.

- Then you will choose the positive payment history you want to be added to your credit file.

- Just like that, your credit file will have the newly added positive payment history and your FICO score will be instantly updated. Experian will provide you with both; the new report and score.

Experian also includes a few more features with Experian Boost. Credit Score Factors, and Credit Score Tracking.

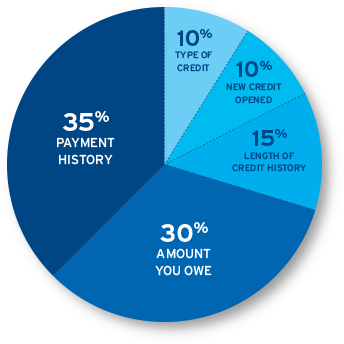

Credit Score Factors are what make up your credit score calculation. Experian provides clarification on how these factors are affecting your scores. There are 5 factors that are used to calculate your FICO scores; Payment history, credit utilization, length of credit history, credit mix, and new credit.

To better understand these factors please read my previous blog posts:

These blog posts will help you learn and understand the 5 factors that FICO uses to calculate your credit scores.

Credit Score Tracking by Experian will track and alert you when any changes occur with your scores. With this feature, you will be able to see what your future scores may be based on what your current credit report trends are.

You will also see what factors are impacting your score the most and least. This is important because you can identify what your strengths and weakness are within the 5 factors used to calculate your FICO scores.

Benefits of Experian Boost

Here’s a list of all the benefits of using Experian Boost at a glance:

- It’s free!!! It saves you money, there are services that add these payments to your credit files, but it’s not free. Rental Karma is one, it adds your positive rent payments to your reports.

- It adds your positive mobile phone and utility bill payment history to your Experian report.

- Your credit report is instantly updated and provided.

- A new FICO score is updated and provided

- Your Experian FICO Score 8 is immediately increased

- You also get two additional features: Credit Score Factors and Credit Score Tracking.

There is much to gain from Experian Boost, however, there are some limitations.

Limitations to Experian Boost

Although there are many benefits to Experian Boost, there are a few limitations. Since this service is offered exclusively through Experian, it can only help with your Experian FICO Score and Report.

In order for it to help your score, the lender you apply with must use the FICO Score 8 model as their scoring system.

If the lender uses a different scoring model other than FICO Score 8 you will not see an improvement in your score.

Experian Boost still helps millions of consumers even with its few shortcomings

Who Does Experian Boost Help

Although all lenders do not use FICO Score 8 model, there has been an increase and a trend of lenders using FICO Score 8, and 9.

This increases your odds of finding lenders you can use after applying the Experian Boost to your report.

Here is who can benefit from Experian Boost:

- Millions of consumers that have no credit at all, meaning no credit cards or loans on their credit report will now have a payment history after using Experian Boost.

- Millions of consumers that have recently had their loan or credit applications rejected will have a much better chance to be approved after using Experian Boost.

- Millions of consumers that can move from a poor credit standing into a “fair” or “good” standing after using Experian Boost

Experian Boost Effectiveness Data

Here are the numbers on Experian Boost

- 10% of consumers with a thin file became scoreable after using Experian Boost.

- 75% of consumers with FICO scores below a 680 saw improvement in their score after using Experian Boost.

- 5%-15% of consumers witnessed improvement into a better FICO score category after using Experian Boost.

- 67% of consumers saw an increase in their FICO scores.

Conclusion

Experian Boost can potentially help every consumer and is worth doing when you weigh all the pros and cons. It can’t hurt, it actually helps!

Go to experian.com/boost to register now. You will have to become an Experian member, however, the membership is free, and no credit card info will be required.

You will receive a free credit report and free FICO Score once registered. Stop thinking about it and increase your Experian score ASAP!